June 22, 2017

Housing Wealth for Homeowners 62 and Older Grew 3.1% in First Quarter

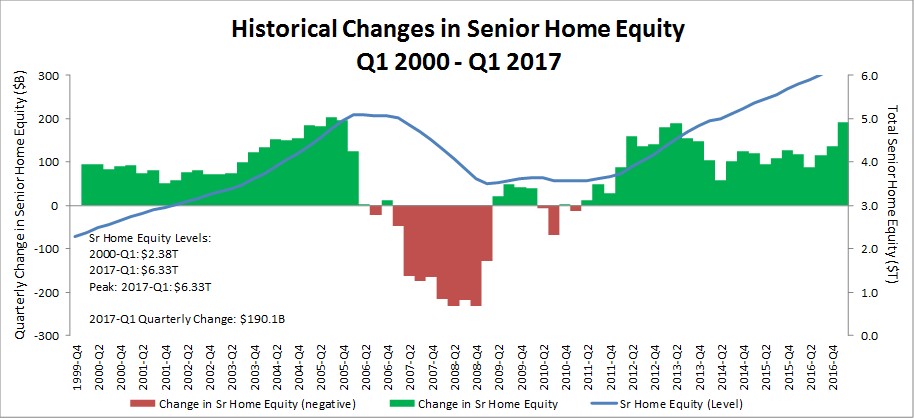

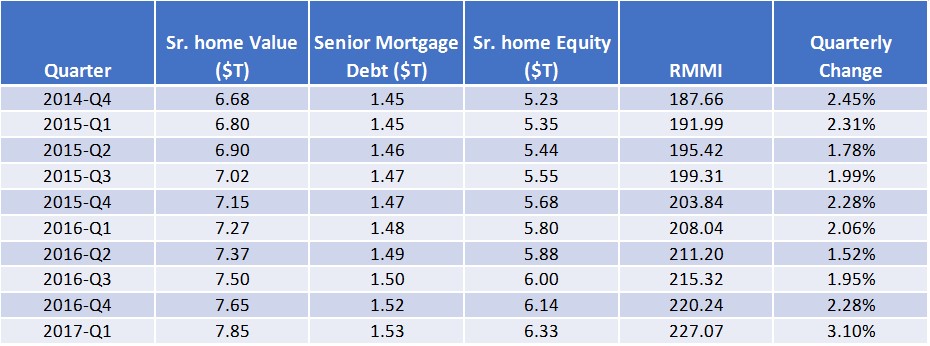

WASHINGTON (June 22, 2017) – The National Reverse Mortgage Lenders Association reports today that homeowners age 62 and older saw their home equity increase by a combined 3.1 percent to $6.3 trillion in the first quarter of 2017 from $6.13 trillion in Q4 2016.

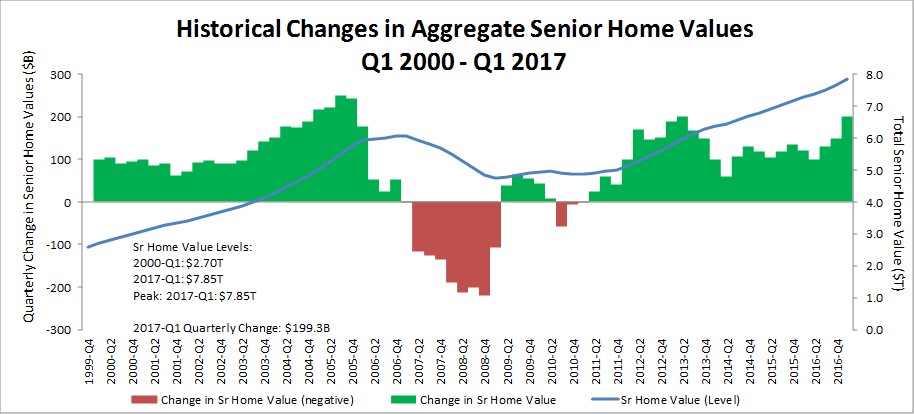

According to the NRMLA/RiskSpan Reverse Mortgage Market Index, the growth in housing wealth for retirement-aged homeowners was driven by an estimated 2.6 percent, or $199.3 billion, improvement in senior home values, and offset by a 0.6 percent increase of senior-held mortgage debt that equaled $9.2 billion. The RMMI, a quarterly measurement of home equity held by older homeowners, rose to 227.07 in Q1 2017, another all-time high since the index was first published in 2000.

“Older adults who want to stay in their own homes as they age, and we know a majority do, may find that the house that was perfect for raising a family lacks the features to support aging in place. But, instead of moving out, various modifications, such as stairless entryways and wider bathroom doorframes, can be made to accommodate new mobility and accessibility needs,” said NRMLA President and CEO Peter Bell. “The housing wealth our seniors have built up in their homes over the years, their home equity, can be used to update the family house into a space for living comfortably and independently for years to come.”

“Aging in an Age Friendly Home: Managing the Costs of Home Modifications with Home Equity,” a recorded NRMLA sponsored webinar for the American Society on Aging, features presentations by Louis Tenenbaum, one of the nation’s leading authorities on aging in place; Todd Brickhouse, an expert on mobility modifications; and Craig Barnes, a Certified Reverse Mortgage Professional who explains how homeowners 62 and older can tap home equity with a reverse mortgage to pay for projects.

To help explain home equity and its uses, NRMLA recently released its “Learn About Home Equity” infographic, and the three-part article, “An Introduction to Housing Wealth: What is home equity and how can it be used?,” which are available on NRMLA’s consumer education website www.reversemortgage.org/HomeEquity.

Prepared by RiskSpan, Inc.

Data Sources: American Community Survey, Census, FHFA, Federal Reserve

Data Sources: American Community Survey, Census, FHFA, Federal Reserve

Prepared by RiskSpan, Inc.

Data Sources: American Community Survey, Census, FHFA, Federal Reserve Z.1 Release

Data Sources: American Community Survey, Census, FHFA, Federal Reserve Z.1 Release

About Reverse MortgagesReverse mortgages are available to homeowners age 62 and older with significant home equity. They are a versatile financial tool seniors can use to borrow against the equity in their home without having to make monthly principal or interest payments as with a traditional “forward” mortgage or a home equity loan. Under a reverse mortgage, funds are advanced to the borrower and interest accrues, but the outstanding balance is not due until the last borrower leaves the home, sells or passes away.

To date, 1,035,486 households have utilized an FHA-insured reverse mortgage to help meet their financial needs. For more information, please visitwww.ReverseMortgage.org

About the National Reverse Mortgage Lenders AssociationThe National Reverse Mortgage Lenders Association (NRMLA) is the national voice for the industry and represents the lenders, loan servicers, and housing counseling agencies responsible for more than 90 percent of reverse mortgage transactions in the United States. All NRMLA member companies commit themselves to a Code of Ethics & Professional Responsibility. Learn more at www.nrmlaonline.org.

About RiskSpan, Inc.RiskSpan offers end-to-end solutions for data management, risk management analytics, and visualization on a highly secure, fast, and fully scalable platform that has earned the trust of the industry’s largest firms. Combining the strength of subject matter experts, quantitative analysts, and technologists, the RiskSpan platform integrates a range of data-sets–including both structured and unstructured–and off-the-shelf analytical tools to provide you with powerful insights and a competitive advantage. Learn more at www.riskspan.com.

Visit us online today @ www.novareverse.com